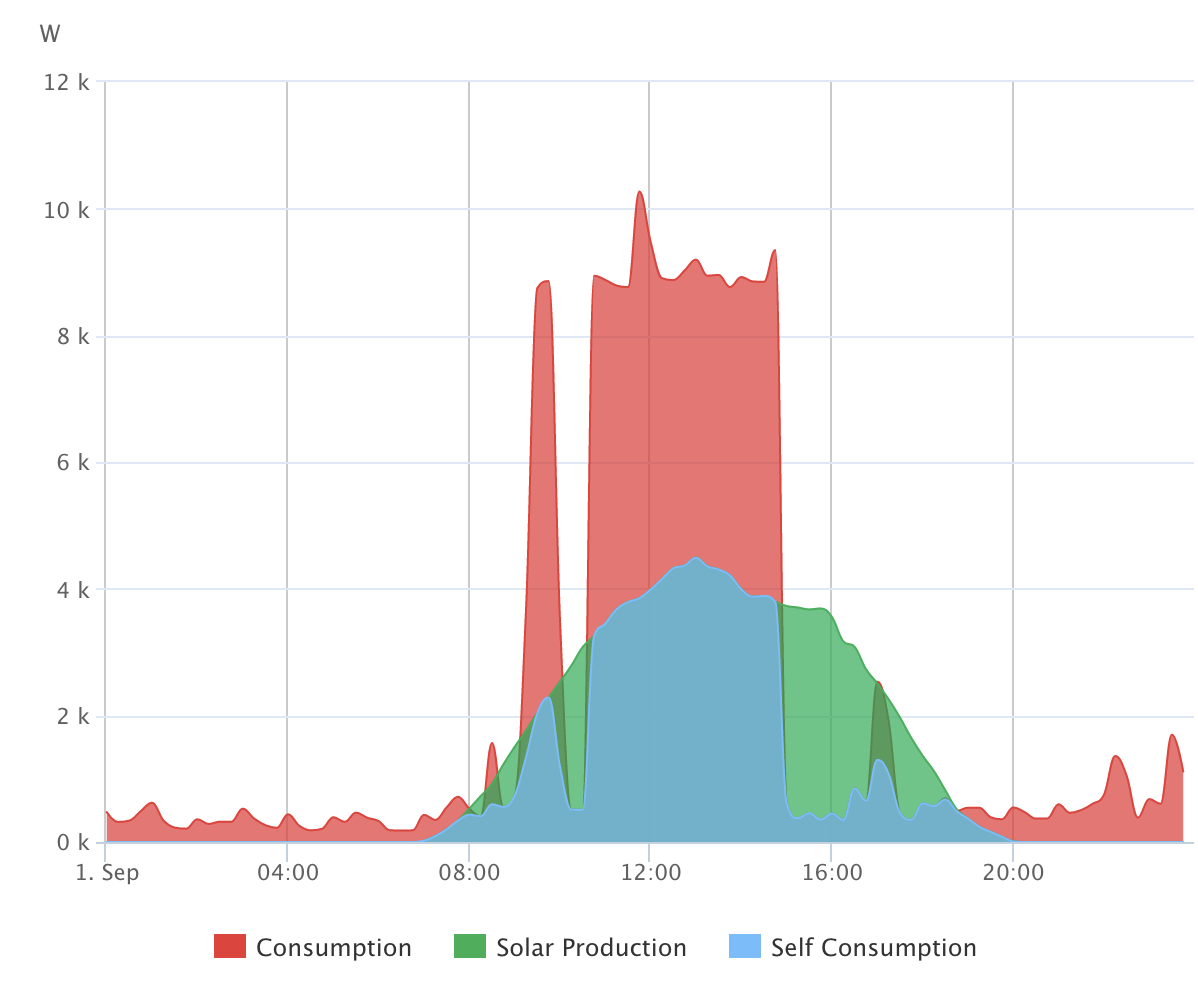

We now have a 6.8kW solar system, installed by the lovely folks at Kite Electric. That’s 16 425W panels (from Q Cells), hooked up via power optimizers to a 6kW SolarEdge inverter. We are 13% DC oversized, which means that during peak production periods we will clip production, but we end up using more of the inverter’s capacity at non-peak times.

Early Results

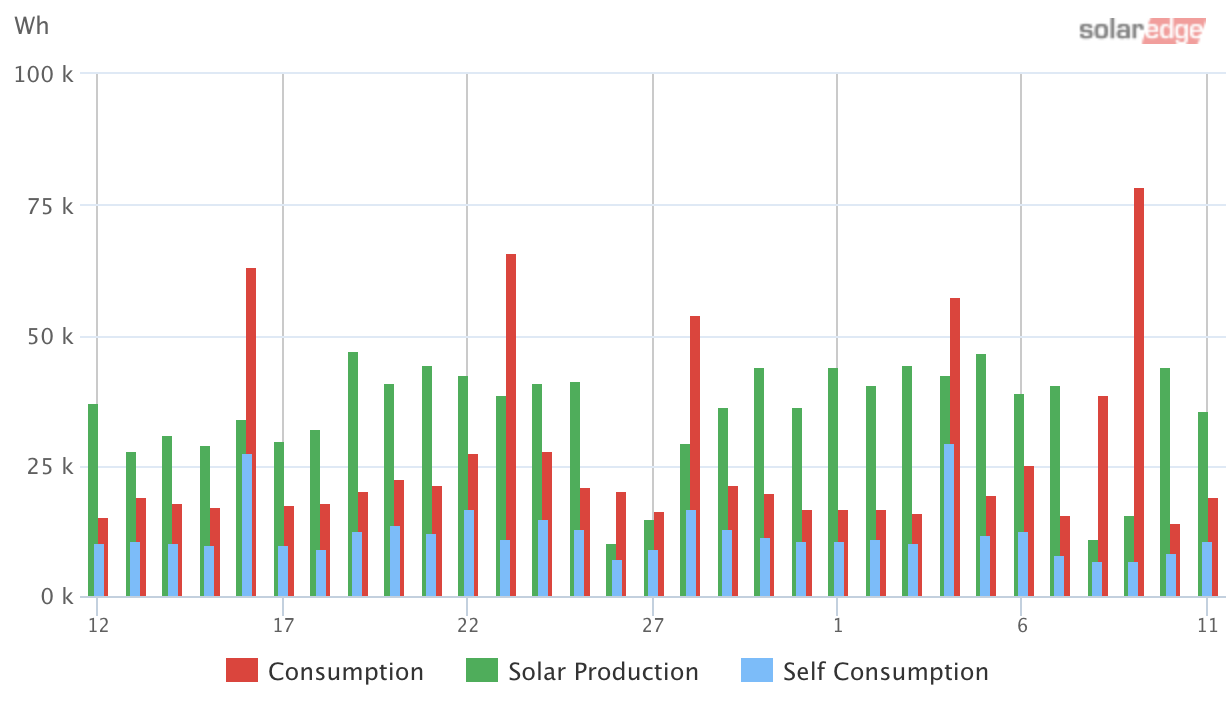

Since we’ve had the system installed, we’ve mostly had semi-cloudy days. August 13th was a nearly cloud free day, and also our peak production day: 45.6 kWh produced. So far, most partly-cloudy days have been above 20kWh.

Financial Modelling

One thing I discovered during the planning for this project is that financially modelling a solar system is hard.

The problems faced when trying to do solar financial modelling are plentiful. First you have problems of trying to model the production of the system itself.

- How much sun do you get? I found that different installers had estimates that varied by 20%! This alone drives a huge chunk of variance in financial modelling. The American NREL has a calculator called PVWatts, but there’s still a huge amount of judgement calls you’d need to try use it (Quick: What % do you use for snow computing system losses?)

Then there’s financial questions:

- How do you model net billing? As hinted at in a previous blog post, the economic benefit of self-consumed kWh is higher than the economic benefit of a kWh exported to the grid, since you're not paying for distribution; but modelling self-consumption is really hard, and would require data (hourly consumption estimates and weather estimates) that I don’t have (though, I am getting an energy monitor installed that should help with that).

- What exactly is your goal in modelling? Are you trying to figure out when the system has produced enough electricity to have paid for its installation? Or when you’re better of having installed the system vs. not.

My Modelling

In the end, I had to accept a ‘good-enough’ solution, because I didn’t have the energy to continue tweaking the model more. This model is wrong, as most models are, but useful. I was interested in one major question:

What was the Relative payoff point: How long after installation would we be better of financially having installed it vs not?

To model this, I projected our electricity consumption forward, and accumulated the amount spent on electricity. The idea being that I would accumulate the amount of money spent on electricity both with and without panels. In the case where I bought panels, I’d treat that as a large first year expenditure, but every kWh generated is treated as negative power spend.

In the end, my model had the following assumptions,

- On energy consumption, assume flat growth, except for an increase half-way through next year related to the expected purchase of an electric vehicle.

- Assume 2% inflation on electricity costs.

- Assume the economic benefits of 100% self-consumption of electricity (so price self-consumption higher).

- No attempts to account for clipping in the modelling; assume DC power output.

- Assume 5 year amortization of financed part of the system.

- Totally ballpark the amount of sun for a year, and how much generation the panels make.

This model has more than a few flaws:

- It doesn’t account for the existence of micro-generator rates.

- 100% self consumption isn’t really accurate

- Inaccurate solar generation estimation.

The result of this modelling was a graph showing two curves: One is the uncompensated electricity spend without panels: This curve slowly bends downward (at a slightly increasing pace as inflation compounds). The other curve starts low, but climbs as the solar system generates electricity. Under this model, the point at where the two curves cross is the Relative payoff point. The point at which the solar curve crosses zero on the y-axis is the point at which the panels paid themselves off (absolute) payoff.

By this model, the relative payoff point for our solar system is roughly 7 years in the future, and the absolute payoff point is about 12 years.